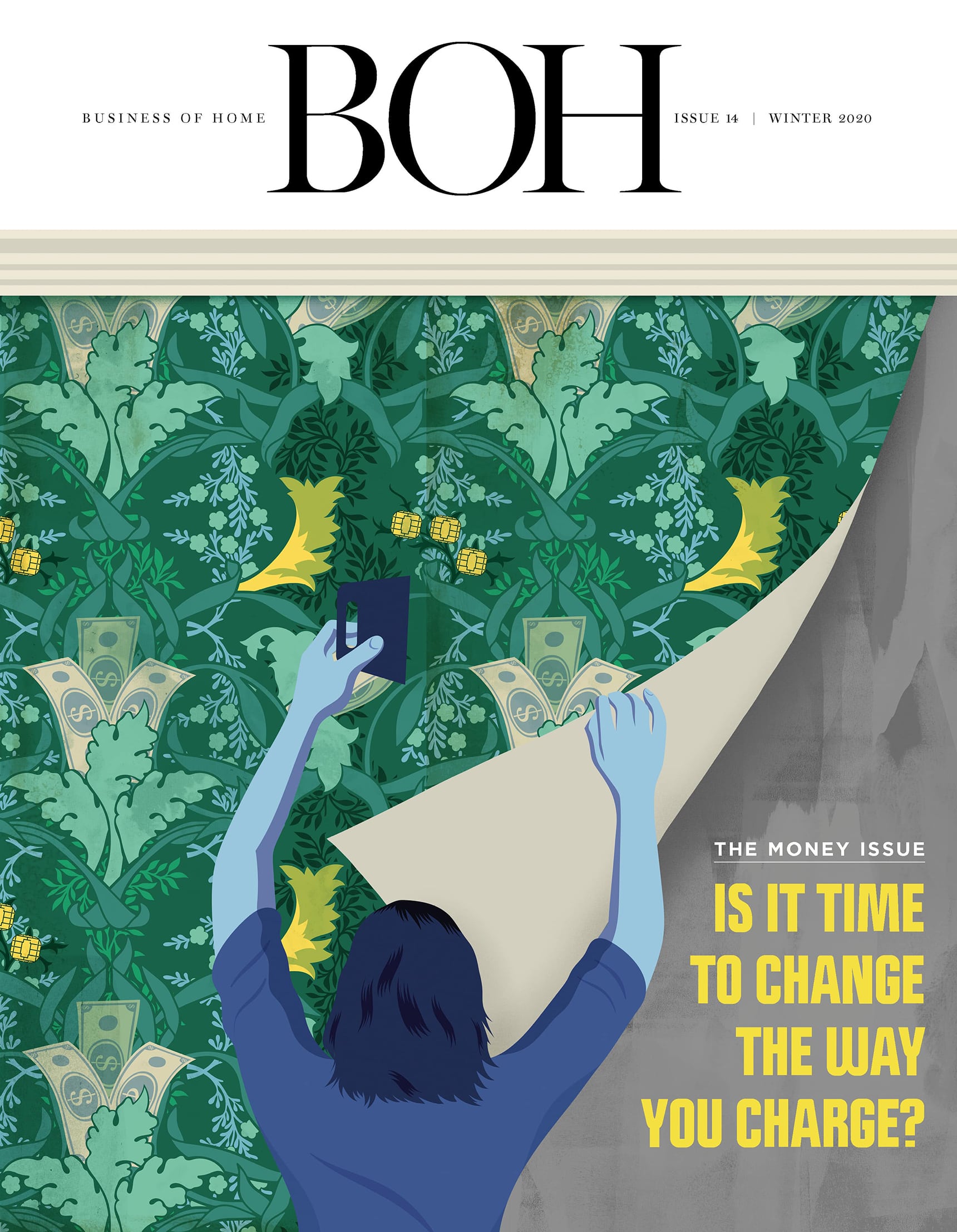

By applying a little creativity and a lot of sound advice, you can turn your billing headaches into solutions that are in sync with your firm’s greater purpose

In theory, billing should be simple: You send your client an invoice for a predetermined rate, and they pay it. In reality, the logistical and emotional mechanics of the process are far more complex. As design firms develop their own billing frameworks, they often adopt an approach that’s more reactive than proactive—combine that with money being a subject fraught with personal triggers, anxieties and biases, and billing can quickly get complicated. The good news is that most designers already have the raw skills to master the nuances of billing—their systems may just need a little refining.

“Designers have been taught to see money in a very linear way,” says Sean Low, founder of coaching consultancy The Business of Being Creative. “If designers allowed themselves to see money the same way they see art or design or space, they’d actually be better at managing money than almost any financial professional.”

Whether you’ve been billing the same way for years or have an ever-evolving approach, it’s worth considering whether your policy is the best fit for your firm—and for your clients. Getting there might require a major overhaul or only minor adjustments, but it will be well worth the effort. No matter what issues you’re navigating, you’ll know you’re on the right path when your billing system minimizes stress, facilitates mutual understanding and timely payment, and eliminates constant course correction, explanation or justification.

Problem #1: Your clients question what you charge

Most designers have experienced the client who just can’t help scrutinizing invoices and negotiating fees. Even if their behavior is on the milder end of the nickel-and-diming spectrum, anytime a client expresses doubt about how you bill, it’s a sign that you could be conveying your value more effectively. To avoid this kind of misunderstanding, you must communicate—both in person and in writing—more clearly and confidently about how you charge.

It’s a lesson that Lexington, Kentucky–based designer Isabel Ladd learned firsthand a few years ago. “I caved in with the one client that negotiated the cost of goods,” she says. “In hindsight, of course, she was devaluing my service before we even got started, and I didn’t stand up for myself. That was on me for not communicating my costs in advance.”

Ladd decided to lay out her terms on paper, and she hasn’t encountered the same pushback since. “I didn’t have a contract [at the time], so that conversation happened after I had done the work,” she says. “But after that experience, I put everything in writing, and now my clients completely respect the process. There’s no negotiation—you just say yes or no.”

Problem #2: You’re not collecting cash upfront

Tell any business coach that you charge clients after you do the work, or—worse—purchase product on a client’s behalf before receiving payment in full, and you’ll get an instant facepalm in response. It can be tempting to put that long-lead sofa or wallcovering on your credit card when you want to keep a project moving. But no matter how much you trust that a client will make you whole, delivering services or goods before payment is always bad business—it’s a financial risk simply not worth taking.

“The biggest internal billing lesson I have learned is not to stray from our processes

by ordering something on a client’s behalf before collecting in full,” says designer Dana Wolter. “If a client is late to pay, I can be fronting money.” Now, her Mountain Brook, Alabama–based firm’s policy is to collect 100 percent of an item’s price before ordering, then bill freight and any other charges monthly.

Of course, it’s not just product that you should cover in advance—it’s your time. Some designers do this by requiring a retainer (or an “engagement fee,” as Low calls it) and billing hourly against that initial sum. Others use a flat fee, which can be broken into payments by project phases. For instance, Ladd charges a $350 fee for an initial consultation that’s paid before she does anything; after assessing the project, she requires an upfront retainer based on the estimated number of hours it will take her and a project manager to complete the job. “Normally, we’re smack-dab on the money, because we use past projects for reference,” she says. “The retainer leads us through the presentation, we include one round of edits, and then our invoices become monthly during production.”

However you get there, the bottom line, says Low: “Always be ahead of the money.”

Problem #3: You’re charging the same for all your time

Whether you bill using a flat or hourly fee, or a combination of the two, your accounting should reflect an important truth: Not all your work is created equal. Whatever your experience, design work is exponentially more valuable than the procurement and installation phases of a project. That should be factored into your rate, regardless of how you administer it.

“The margins for the design process should be about 75 to 80 percent,” says Low. “The design phase is short, but it’s incredibly valuable—the most valuable money you can earn. Let’s say you are charging $100,000 upfront for a yearlong project, assuming the design phase is four months and the production and installation phases are the remaining eight months. You should keep $80,000 for the design work, then, once the project hits production, start charging upfront monthly for the rest of the work, whether it’s a 35 to 40 percent commission on purchases, or an hourly rate or whatever.”

If you currently charge one hourly rate from start to finish on a project, consider increasing that rate for the design phase to reflect the value of your vision. “You want to match the most important part of your work with the money you’re getting,” says Low. “If you’re getting paid the same amount per hour to create a floor plan as you are to order a lamp, you’re saying the two tasks are equally important. They’re not.”

As a bonus, this method ensures that you front-load the most lucrative part of the project, meaning that if it ever derails unexpectedly, you’ve already earned a solid fee for your creative output.

Problem #4: Your billing benchmarks are off

Instead of billing for time increments, try focusing on deliverables when breaking up your charges. This could mean reconsidering when you bill, or simply tweaking your invoice format to reflect big-picture project phases rather than individual line items.

After countless experiments with various methods during her 19-year career, Katy, Texas–based designer Veronica Solomon of Casa Vilora Interiors ultimately landed on

a flat fee paid in three increments: upon signing the contract; at the presentation; and an “overage” bill toward the end of a project to account for any unpredictable costs. For her, this option works better than having to issue monthly invoices.

“This is the only structure that I feel is fair to both my firm and our clients,” says Solomon. “We start with the end result we’re trying to achieve, then factor in all the resources needed to make it happen, with time—one of our practice’s most valuable resources—being a key metric. As soon as a client signs our agreement, we send the invoice for the full estimated fee, and at least 50 percent is due before we start work.”

By taking a large payment at the beginning of a project, Solomon’s approach front-loads revenue, which covers her overhead costs. It also makes for healthy, easy client relationships. “I find that getting billing out of the way and focusing on design and project management means you’ll have happier clients [because they’re] not stressed out about more invoices,” she says.

Problem #5: You’re undermanaging client expectations

Some clients want to hear about every step of your design process, while others prefer to keep things high-level. Whatever the client’s communication style, it’s essential to ensure your approaches are compatible—and problem-solve if they aren’t. Otherwise, your differences are likely to turn into misunderstandings, something that could be especially problematic with a hot-button issue like money.

New Providence, New Jersey–based designer Swati Goorha prefers to err on the side of overcommunicating when it comes to billing. “I’ve always found that clients prefer to know in advance what things will cost rather than be surprised later,” she explains. “When we estimate our hours, sometimes clients will ask us, ‘Wow, will it take that long?’ That opens the door for a conversation to help them understand the details and time that go into a project.”

To avoid client backlash if numbers change down the road, she has learned to emphasize that a cost estimate is just that: an estimate. “We had some custom work that the workroom estimated based on initial drawings before construction,” says Goorha. “Later, due to site construction, the pricing of the final estimate went up significantly. The client was not happy. Now, we ensure that the client understands that the final number may change when it comes to custom on-site quotes.”

Problem #6: Your terminology needs an upgrade

Clear messaging matters, especially when it comes to money. For industry outsiders, the term markup often carries an unfortunate stigma, due to confusion—not to mention raised eyebrows—about the way designers profit from the products they sell.

“The word markup is a misnomer,” says Low. “That’s what the industry has always called it, but it’s not a markup. You’re an agent, and the percentage you make on a product is a commission.”

In an effort to avoid any negativity associated with the term, some designers have dropped it from their vocabulary—and have seen positive results. (One popular replacement is procurement fee, which links the charge to the services rendered throughout the procurement process.)

“I explain to clients that I make a profit on goods,” says Ladd. “I will never share what my profit is—it’s proprietary and confidential, and it varies based on IMAP [internet minimum advertised price], which is the lowest pricing a consumer can find online. But I stand behind the products I represent and I will go to bat for them; I’m fully responsible for [quality control] and damages. After the bad experience with the client who said, ‘I know how much designers make on stuff, and I’m not going to pay that,’ my pricing policy is in my contract. Working with me is like going to a store: You can buy it or not.”

Problem #7: You’re not DEEP in the details

Some designers love having their hands in their firm’s money management; others couldn’t be less interested in the financial nitty-gritty. But what is certain is that you must keep an eagle eye on cash inflow and outflow—at least until you find another set of trusted eyes to do it for you.

.jpg)

Goorha learned that lesson the hard way two years after launching her firm. “We had a vendor whom we had overpaid by $11,000, and somehow, our old bookkeeper did not catch it,” she recounts. “When we hired a new bookkeeper, we realized the overpayment to a couple of vendors amounted to over $20,000. The checks were mailed; the vendors said they hadn’t received them, so we sent an e-check; and in the interim, they received and deposited the original check instead of shredding it.” Yikes.

Thankfully, Goorha was able to recover the money, but the mishap changed her approach. “It taught me that to run this business efficiently, I needed to learn all the financial aspects, not just the creative ones,” she says. “That [put] our business on a new track. There are so many small things, like credit card fees, [where we can] be efficient, save and be more profitable.” Reviewing the books weekly and keeping a close eye on financials—even as she delegates much of the day-to-day accounting—has reduced the risk of such snafus going forward.

Problem #8: Your rates are not high enough

Increasing your fees can mean rethinking your worth, as well as how you quantify and present that to clients. After raising her hourly rate from $125 to $225, and then to $250, Ladd also formalized her preferred ways of working in a “super digestible” contract with details like no texting with clients and expected response times. The combination quickly translated to smoother billing dynamics that align with her firm’s approachable-yet-elevated identity.

Building money talk into routine client conversations is a seemingly small step that can prove transformative. “My favorite thing to say is, ‘I can build castles in the sky, but it all boils down to budget,” says Goorha. Through transparency and directness, she cultivates ease around a touchy topic, setting the tone for future money discussions.

Whichever billing system you land on, own it, embrace it and speak with conviction about it, from your rates to your invoices and the fine print in your contract. “Lack of confidence always reflects in how designers set their fees,” says Solomon. “I realized that of all the designers my client could have chosen, they chose me. And if I’m putting in the work needed to make their vision a reality, I need to be paid well.”